4.2 KiB

DeepDive into Liquid: Part III - Advanced Asset Functions, Peg-Out, Discussion

This is a multipart DeepDive that will focus on the Liquid Sidechain. It will be released in 3 Parts:

- Part I: Overview, Installation, and first Peg-In

- Part II: Asset Creation and Configuration

- Part III (this): Advanced Topics and Peg-out

Advanced Asset Topics

In Part II, we focused on issuing Assets. Now let's look at the ways you can use assets.

One of the most basic usecases for a custom issued asset is to exchange it for something else. For purposes of discussion, let's assume that a company - say StackerNews Airline - wants to issue their clients "Air Miles" for each flight they take. The idea is clients will accrue these points and then be able to exchange them for either discounts off future flights or direct cash (ie. USD / BTC).

If we start thinking like a developer for second, all of this implies lots of little things to be built: We would need an accounting system to manage the points, we would need some way to issue these points to the clients, who themselves would need some a way to store and manage their points. Further, there would need to some type of middleware to handle the exchanging of points for cash. Also there is a big question of security...could development staff - either intentionally or unintentionally - wind up giving away millions in points? Sure, Stacker News could just do all this themselves using SQL, but lets suppose that since they were clever boys & girls, so they wanted to do as little of the hard work as possible.

Liquid would make a great solution for this case. They could simple direct their users to download one of the existing Liquid wallets[^1] and use the Liquid sidechain as the "accounting system" for their asset.

Atomic Swaps

So our client has 1 StackerNewsDemo-1 token in their wallet (which for our purposes is our pretend airline mile token) and he wants to exchange that for L-BTC. How do we do that?

Obviously, we could build some type of webservice that had SQL databases and nodejs files that accept Asset A and then issued Asset B once received...however as we said our StackerNews crew is smart and therefore prefers to do less hardwork

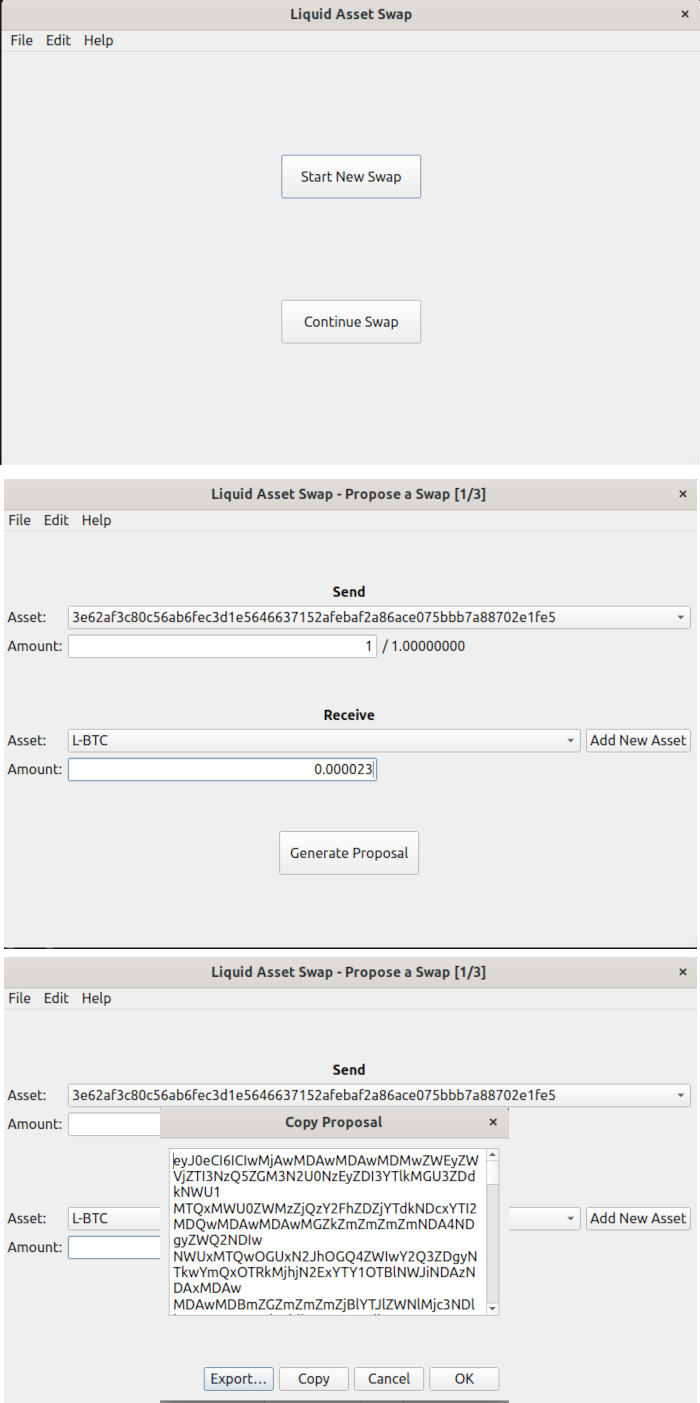

Luckily, due to the additional OPCODEs in Liquid, it supports atomic swaps between assets. In fact, Blockstream has a tool to simplify using it (obviously the steps we do here manually with the tool would be automated within the server / client in production).

Securities / Transfer Restricted / etc

Pegging Out

Discussion

Lightning Integration

Using Liquid with BTC / LN

Comparing eCash / Lightning / Liquid / BTC

| eCash | Lightning | Liquid | BTC | |

|---|---|---|---|---|

| UTXO Model: | No UTXO. Bearer token | Your UTXO is in a multisig. | You own UTXO in sidechain | You own UTXO in mainchain |

| Redemption: | Depends on mint | No dependency (might require fee) | Depends on Federation | No dependecy |

| Longevity: | Mint must survive | Channels will close at somepoint | Federation must survive | UTXO forever |

| Online: | Must be online to verify eCash token | You must be online to recieve. You must stay online (or hire watchtower) to secure channel state | Offline receive | Offline receive |

| TXN Time: | Instant transactions | Instant transactions | Fixed 2 min transactions | Variable ~10 min transactions |

| Fees: | No fees | Neglible fees (msat) | "Low" fees (~200 sats) | High fees (~15,000 sats) |

| Liquidity: | No liquidity management | Must manage liquidity (in/out) | No liquidity management | No liquidity management |

| Privacy: | Mints can aggregate and assemble transaction data | Nodes could aggregate and assemble transaction data | Confidential transactions | Absolute public ledger |

| Federation: | Must vet each Mint | You choose channel partner | Known federation members | Soverign |

| Frac Reserve Possible: | Yes | No | Verifiable Issues | No |

| Likely Threat: | Debasement or Mint rug | Theft of funds while offline | Federation censorship | Losing keys / unspendable UTXO for fees |

| Maturity: | 2023-2024 | 2018 | 2018 | 2009 |