4.3 KiB

Liquid DeepDive

This is a multipart DeepDive that will focus on Liquid Sidechain. It will be released in 3 Parts:

- Part I (this): Overview, Installation, and first Peg-In

- Part II: Asset Creation and Configuration

- Part III: Advanced Topics and Peg-out

Overview

Liquid is a federated sidechain to BTC. The federation which controls the network are known as 'Functionaries'. Currently, there are 15 such Functionaries who are geographically dispered to help isolate the network from both physical and regulatory disruption. Block signing happens in a round-robin style arrangement. ^^Consensus requires 11-of-15 to be available^^.

A unique aspect of this federation is that membership is dynamic - using a protocol known as DynaFed - this allows members to be rotated out/in depending on circumstance. The method the functionaries use to actually sign is known as ROAST (Robust Asynchronous Schnorr Threshold Signatures). As stated:

"It guarantees that a quorum of honest signers, e.g., the Liquid functionaries,

can always obtain a valid signature even in the presence of disruptive signers

when network connections have arbitrarily high latency. Our empirical performance

evaluation shows that ROAST scales well to large signer groups, e.g., a 67-of-100

setup with the coordinator and signers on different continents. Even with 33 malicious

signers that try to block signing attempts (e.g. by sending invalid responses or by not

responding at all), the 67 honest signers can successfully produce a signature within

a few seconds."

The main benefit of ROAST is that signing becomes less problematic when there are a very large numbers of federation members. Obviously this along with the inclusion of DynaFed (a recent addition to the network), seems to indicate that they plan to increase the total federation functionaries in the future.

Functionaries Sign, not Mine

A key aspect of Liquid is there is no mining. The core asset, L-BTC, is only created when BTC pegs-into the network, so unlike Bitcoin, mining is not used to create issuance of new coins. The total amount L-BTC can be verified along with the equivalent amount of BTC, which are held in a public multisig address. This ensures that there is no inflation possible of L-BTC, since it is issued 1:1 with the pegged BTC.

By default, all Liquid transactions use ^^Confidential Transactions^^, so both the type of assets and amounts transacted are hidden, even to functionaries. However, Functionaries (who sign the transactions), can still see the from / to addresses involved - they only don't know what is being transferred.

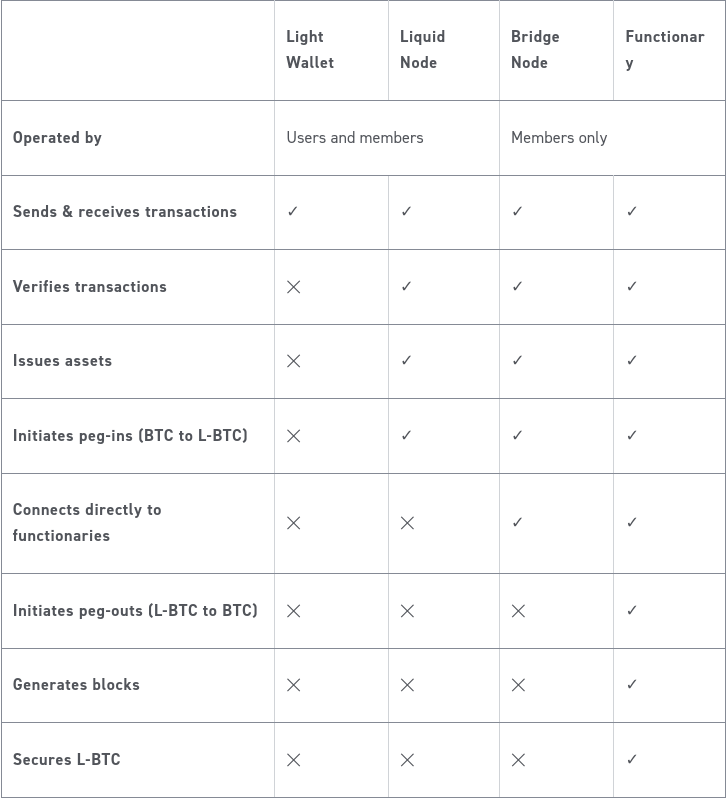

Liquid Ecosystem and Roles

Here are some charts showing current ecosystem members and the roles various members can fulfill.

Assets

One of the unique aspects of Liquid Network is that it supports a variety of Asset Issuance models that any full-node can perform. These assets fall into the following categories / use-cases:

* Tokens (e.g. arbitrary token issue, stablecoin, etc)

* Swaps (e.g. atomic swap of Token A for Token B)

* Options / Smart Contracts / Covenants (e.g. swap Token A for B when condition ABC is met)

* Securities (e.g. issue dividends to Token A holders after time)

* Restricted Assets (e.g. prohibit Token A holder to transfer tokens until approval given)

Additional Opcodes

In order to support the Smart Contracts and Convenants seen above, Liquid includes several opcodes, in addition to the ones already supported by Bitcoin:

It reintroduces some safe but disabled opcodes, including string concatenation (CAT), substrings, integer shifts, and several bitwise operations (see here).

A new DETERMINISTICRANDOM operation which produces a random number within a range from a seed.

A new CHECKSIGFROMSTACK (CSFS) operation which verifies a signature against a message on the stack, rather than the spending transaction itself.

These new opcodes have several use cases, including double-spent protection bonds, lotteries, merkle tree constructions to allow 1-of-N multisig with huge N (thousands), and probabilistic payments.